Matching Gifts

- News

Maximize Your Donation Using Someone Else's Dollars

Written by Jodi L. Bopp, CFRE, Vice President, Advancement, Boundless

The primary reason anyone makes a charitable donation to Boundless is simple: people want to make a difference in the lives of those Boundless serves.

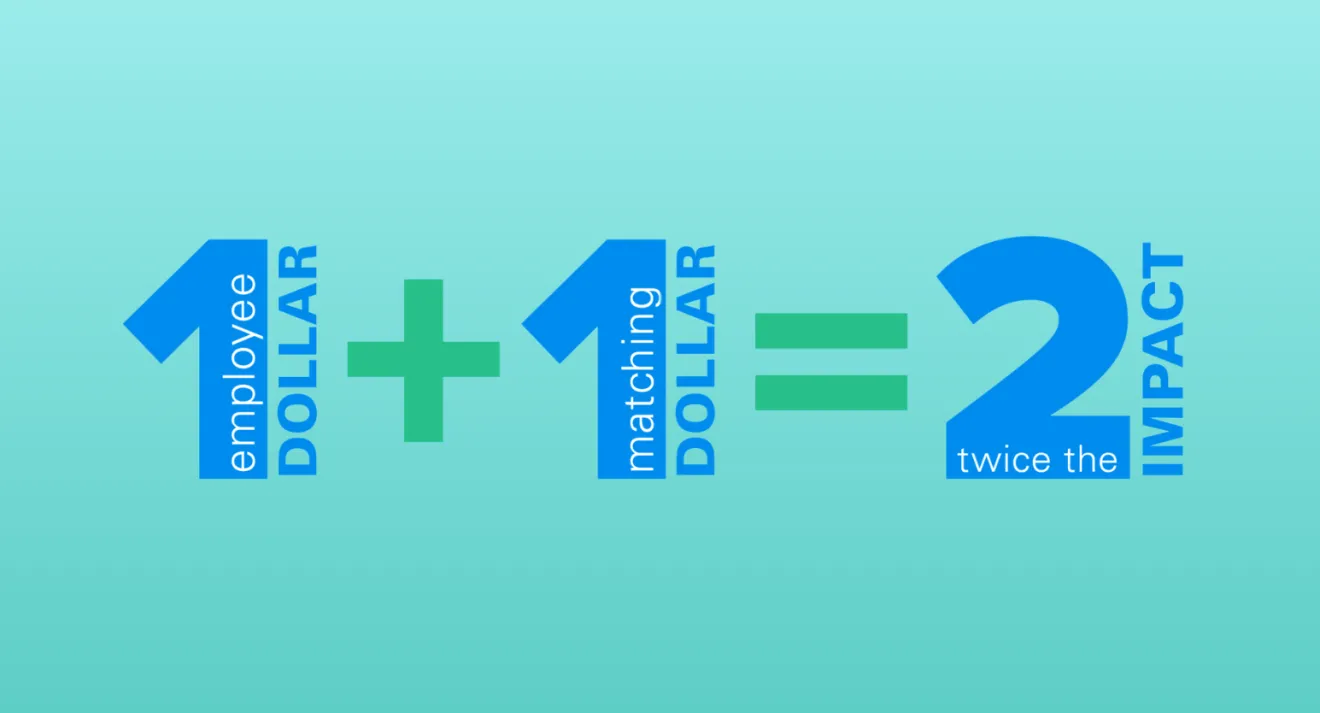

For some, it’s possible to make an even bigger impact through corporate matching gift programs. Through matching gifts, your donation can stretch even further – even double what you’ve already given.

How does it work? It's simple. If your employer – or your spouse’s employer – has a matching gift program, you follow three easy steps:

#1 Make your own gift to Boundless.

#2 Complete the necessary matching gift process per your company’s instructions.

#3 Boundless receives additional dollars to support mission-critical programs and services.

To find out if your company makes matching gifts, you can search this site: https://ww2.matchinggifts.com and enter the name of your company. If you work for a company that’s a subsidiary of a larger corporation, you may need to enter the name of the parent company. Or a company’s Human Resources department can also let you know if a matching gift program exists.

Accessing matching gift funds is generally very simple. There’s usually a matching gift form which asks you, as the original donor, questions about how much you’ve already given and when. The form generally needs to be completed by Boundless, acknowledging your gift was received and that Boundless qualifies under the company’s matching gift program parameters. Once completed, the form is returned to the company making the matching gift for processing and distribution.

Please note: If the company has never sent a matching gift contribution to Boundless before, they may want to talk to us or have us complete paperwork to make sure we’re a legitimate charitable organization. We welcome this conversation and once we’re in the company system, there’s no need to complete this step again.

Matching gifts can often apply to your contributions or to your spouse’s contributions. Many companies also allow matching gifts to be applied even after you’ve retired from their employment.

While you, as original donor, receive no additional tax credit for the matching gift funds, you can receive recognition credit with Boundless for maximizing your contribution and, most importantly, you are providing additional resources to support the Boundless mission.

If you have questions about maximizing your donation through matching gifts, please give me a call at 614-505-1603.